Interest Rates Cut to 3.75% Explained Clearly

Interest rates are a critical tool used by central banks to influence economic activity. When the central bank, like the Federal Reserve in the U.S., cuts interest rates to 3.75%, it aims to stimulate the economy by encouraging borrowing and spending. Understanding the implications of such a decision requires a grasp of how interest rates affect various sectors of the economy.

The Basics of Interest Rates

Interest rates are the cost of borrowing money. When rates are high, loans become more expensive, which can deter individuals and businesses from borrowing. Conversely, when rates are lowered to 3.75%, loans become cheaper. This can lead to increased spending by consumers on items like homes, cars, and education, and enable businesses to invest in new projects or expand operations without the burden of high repayment costs.

Impact on Consumption and Investment

With lower interest rates, consumers are more likely to take out loans for big-ticket items. Mortgages become more affordable, thus increasing home sales and making housing more accessible. Similarly, lower rates can lead to higher credit card spending and increased loans for education or personal purposes. Businesses, too, benefit from lower borrowing costs. Companies are more inclined to invest in new technologies, infrastructure, or hiring, which can stimulate job creation and productivity.

Effects on the Stock Market

Interest rate cuts often have a positive impact on the stock market. Lower borrowing costs can lead to higher corporate profits, as companies save money on interest payments. This can increase stock valuations and attract investors seeking better returns than those offered by low-yielding bonds. If investors anticipate sustained economic growth due to increased consumer spending and business investment, they may flock to the stock market, driving up prices.

Inflation Considerations

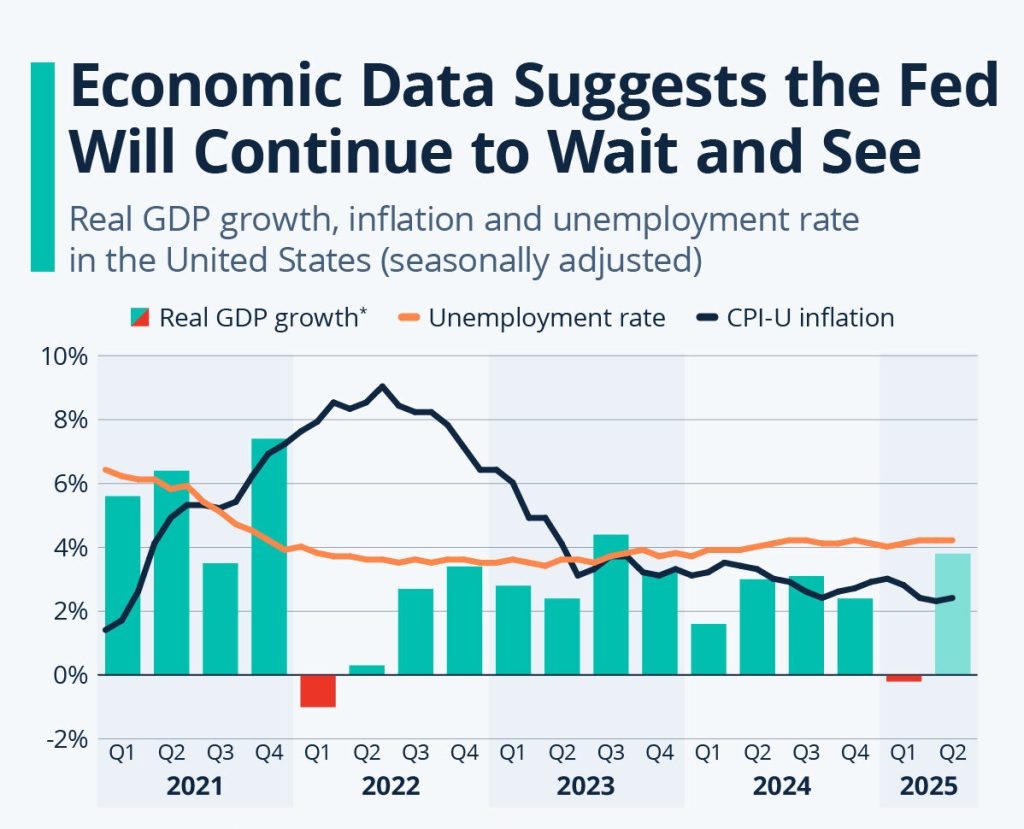

While lowering interest rates can stimulate economic activity, it’s essential to consider the relationship between interest rates and inflation. If the economy grows too quickly, demand can outpace supply, leading to rising prices. Central banks aim to balance stimulating growth while keeping inflation in check. If inflation starts rising significantly, the central bank may need to consider raising rates again.

Conclusion

A cut in interest rates to 3.75% is a strategic move designed to stimulate economic growth. It encourages spending and investment, benefiting consumers and businesses alike. While this can lead to a flourishing economy, careful monitoring is necessary to keep inflation within acceptable limits. In summary, understanding the nuances of interest rate changes can equip individuals and businesses to make informed financial decisions during fluctuating economic times.

For more details and the full reference, visit the source link below: