The silver market has always been an intriguing sector for investors, and recent trends indicate a significant shift that could redefine its landscape by 2025. As we delve into the current market conditions and potential future developments, several factors emerge that may cause substantial fluctuations in silver prices.

One significant trend influencing the silver market is the increasing industrial demand for the metal. Silver is not just a precious metal for jewelry and investment; it plays a critical role in various industries, particularly in renewable energy technology. With the global shift towards sustainable energy solutions, the demand for silver in solar panels and electric vehicles is surging. According to industry experts, the renewable energy sector is expected to require a significant increase in silver, with projections indicating a potential price increase as supply struggles to keep up with this growing demand.

Moreover, geopolitical tensions and economic instability can have profound impacts on precious metals. Investors often flock to silver as a safe-haven asset during times of uncertainty. The ongoing global economic challenges, including inflation and fluctuating currency values, are causing many to reevaluate their investment strategies. Silver has historically proven to be a solid hedge against inflation, and as central banks continue to print currency, this trend is likely to continue, possibly pushing prices even higher by 2025.

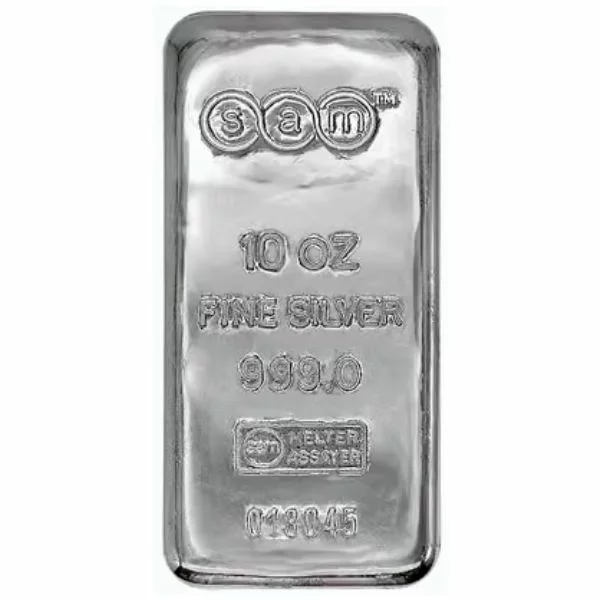

Additionally, the impact of digital trends cannot be overstated. The growing popularity of cryptocurrencies and decentralized finance has sparked interest in alternative assets, including silver. A new wave of investors, particularly millennials and Gen Z, are turning to physical assets like silver as part of their investment portfolio. This shift could lead to an increased demand for silver bullion and coins, potentially driving prices up.

On the supply side, challenges loom large. Silver mining is a complex process that requires significant investment in both time and resources. Many existing silver mines are facing declining outputs, while new projects are struggling to come online due to environmental regulations and capital constraints. This supply squeeze could exacerbate the upward pressure on prices, particularly as demand from both industrial and investment sectors heightens.

In conclusion, the silver market is on the verge of exciting developments. By 2025, various factors, including industrial demand, economic uncertainty, and changing investor attitudes, are expected to influence silver prices significantly. While predicting exact price points can be challenging, it’s clear that the combination of rising demand and constrained supply could lead to a scenario that surprises even the most seasoned investors. As always, prudent investment strategies and thorough research are essential for navigating this dynamic market.

For more details and the full reference, visit the source link below: